Gaining Traction in a Subscription-Based Economy

The Subscribed Institute is a think tank for the subscription economy that has issued several insightful studies providing benchmarks and playbooks for businesses in the subscription-based economy.

The institute manages a community of hundreds of executives and experts, provides consulting services, and also organizes events such as workshops and summits.

The Zuora’s Subscribed Institute hosted an event in Munich to talk about the status quo for subscription-based businesses by looking at data connected to pricing, discounting, churn, growth rate, and more.

The institute has access to thousands of anonymized aggregate data points collected through hundreds of subscription-based businesses worldwide.

Let’s sum up some of the most notable details that were presented at the event in Munich.

Table of Contents

Understanding the Subscription-Based Business Model

70% of organizations around the globe have deployed or are considering subscription services” – Gartner

Industry leaders are reinventing growth by continuously introducing new business models. And the biggest revolution of our era is the “as-a-service” shift that is currently transforming the business model of basically every large corporation across the globe.

We’re used to subscription-based services: companies like Netflix, Dollar Shave Club, Hulu, and Spotify have been part of our daily routine for years now.

But the subscription-based business model has infiltrated almost every vertical in virtually every industry.

We now have companies like GM and Maas Global that are becoming leaders in mobility-as-a-service (Maas) and CAT and Husqvarna dominating the sector of machine-as-a-service (or equipment-as-a-service) by leveraging IoT technology.

And the list goes on and on to include BaaS and BPaaS (business-as-a-service and business-processes-as-a-service) solutions like NCR and Tyco, home-as-a-service companies (HaaS) such as Vivint, Nest, and Hive, energy-as-a-service (EaaS) providers such as EDF or Enel, and wellness-as-a-service (Waas), which is currently using wearable technology to decentralize healthcare.

I recently spoke at the Aviation Symposium in Munich and the hot upcoming trend across a variety of talks always seemed connected to solutions such as fleet-as-a-service (FaaS). The list is basically infinite.

The B2B world is currently being dominated by “as-a-service” vendors from platform-as-a-service (PaaS) providers to infrastructure-as-a-service (IaaS), and, obviously, software-as-a-service (SaaS) products.

For large companies, the SaaS business model is like going back to the origins. In fact, we mustn’t forget that the SaaS business model was very common in the seventies when hard drives were still too expensive.

The second wave of SaaS applications was spearheaded by Salesforce that decided to tackle the modern enterprise world with a cloud-only version of their software (in a world that was getting to know DVD roms and large server rooms).

Nowadays, apart from a small group of resilient companies, cloud migration has already occurred or is currently being planned at every large corporation worldwide.

But no matter whether B2C or B2B, SaaS or MaaS, the question is: how different is the business model of a subscription-based provider from a traditional business approach?

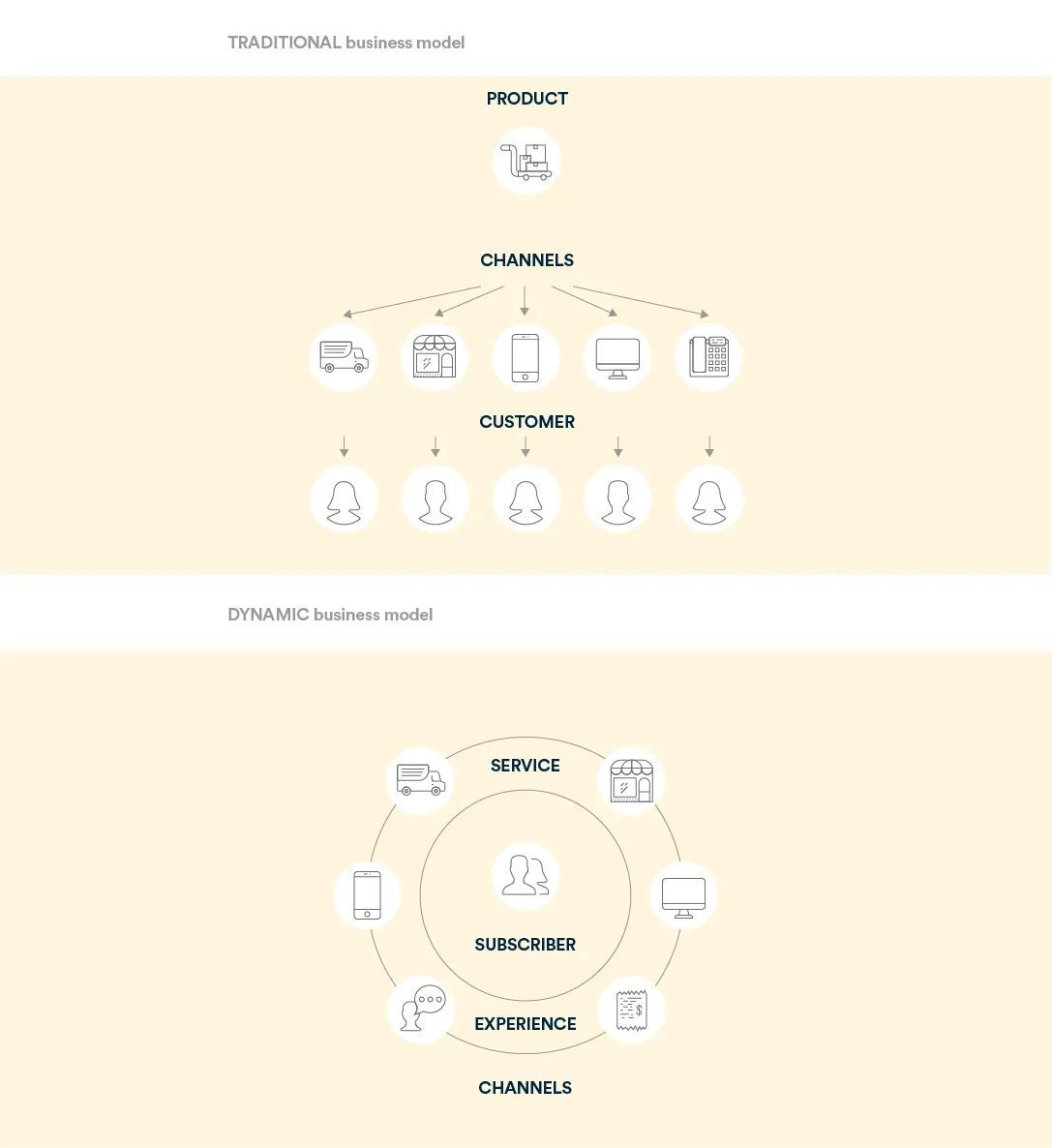

The traditional business model is based on value-adding supply chain processes that focus on the product itself and its distribution channels to reach customers to trigger sales and encourage repeat purchase.

The subscription-based business model involves a whole new dynamic approach which is primarily linked to a change in mentality. It’s a new way of thinking that hinges on the subscriber and their relationship with the brand.

The subscriber becomes the center of the business strategy, which then revolves around creating specific services and experiences that lead to subscription and retention.

The product itself and its features is an essential component, but the overall customer experience becomes the deciding factor that leads to growth.

Customers in the subscription-based economy don’t purchase products. They buy experiences.

And such experiences, besides being memorable and pleasant, also need to present specific characteristics such as being frictionless, customizable, and portable.

The Key Element of Successful Subscription-Based Businesses

The main difference between traditional businesses and subscription-based businesses lies in the fact that customers of old-economy companies often had either just one or spaced occasional points of contact with the brand.

A customer would purchase a product and maybe return some time later to purchase again because they were enticed by a new offer, an upgrade, or complementary products that the company would also offer.

Subscription-based businesses don’t create single transactions. Successful subscription-based businesses build long-lasting relationships.

And that’s because for a subscription-based company, the customer is a subscriber.

The main focus of modern businesses is not creating as many transactions as possible but creating a strong bond with each subscriber to avoid churn.

And in order to avoid churn, companies need to maximize the subscriber value they offer to their customers at each step of the customer journey.

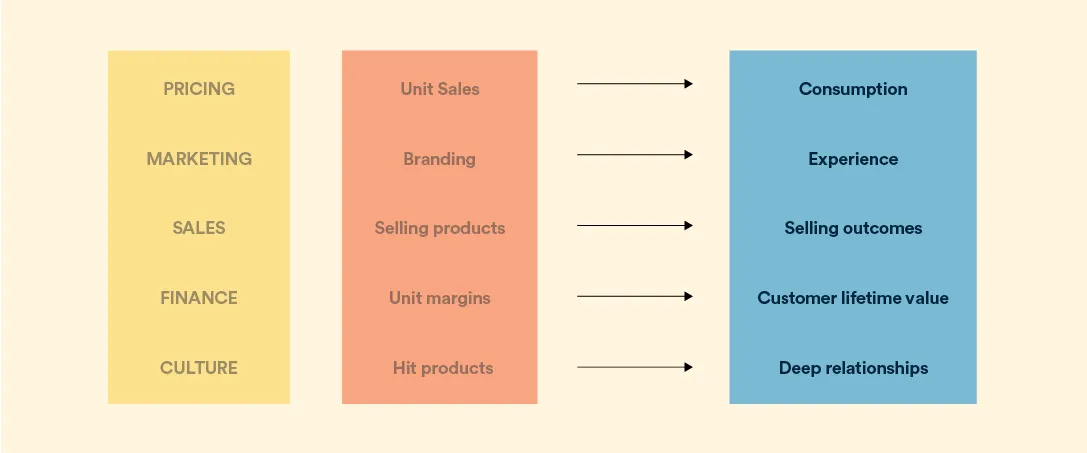

How do traditional companies make profit? By optimizing their cost structure (lowering their cost per unit), maximizing prices, reaching more customers, and selling more units.

The growth rate of subscription-based businesses is linked to very specific subscription-business metrics.

The subscription economy forces companies to focus on retention and increased subscriber value. Of course, reducing customer acquisition costs (CAC) play an important role as well. But the main driver of growth is customer lifetime value (CLTV).

Businesses in the subscription economy wanting to thrive focus on reducing churn while increasing their ARPA (average revenue per account) to dilute CAC and grow organically through expansion and advocacy.

To achieve this, companies need to focus all their energy on creating meaningful experiences and providing constant value for their subscribers.

The Subscription-Based Economy in Numbers

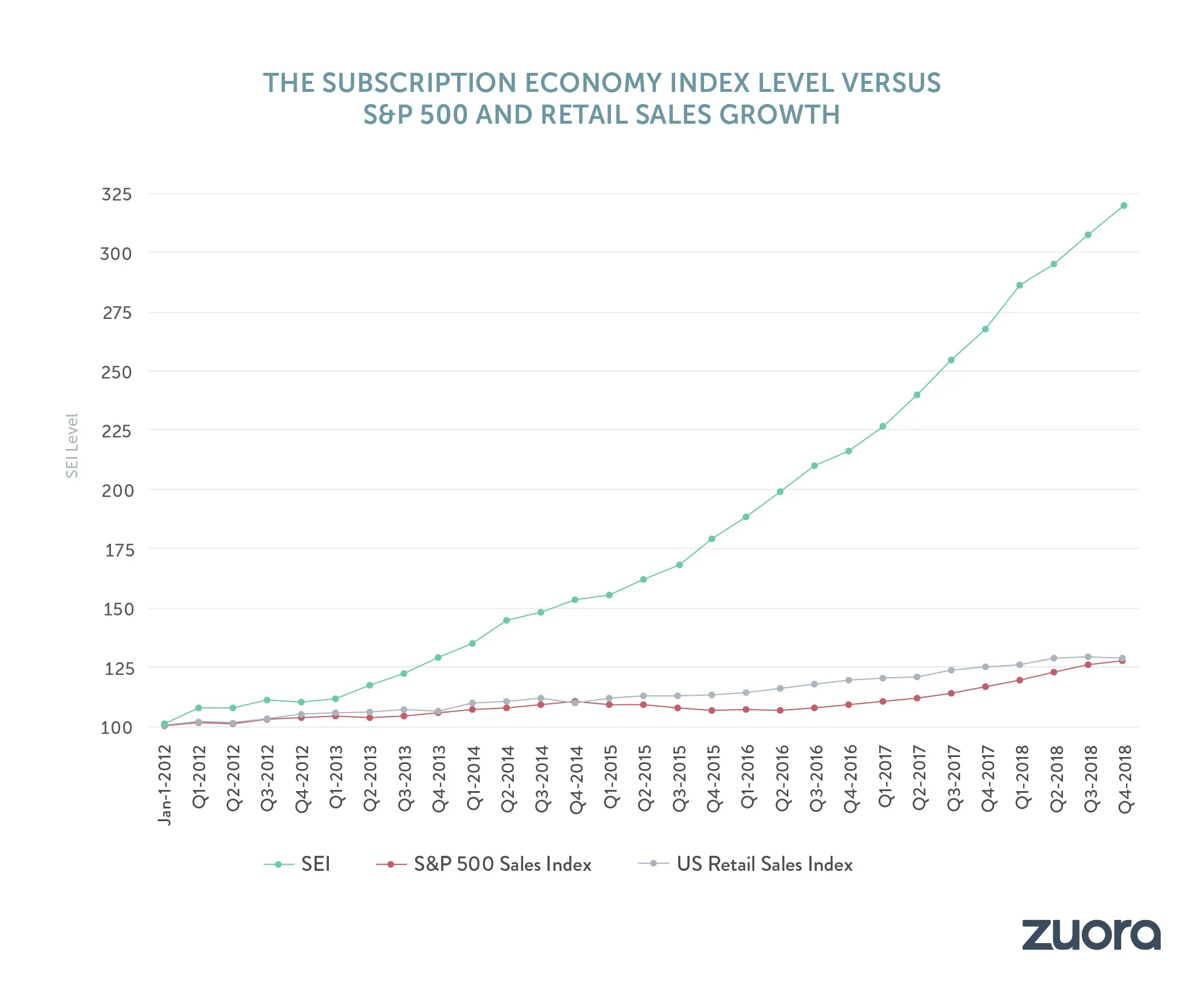

If we look at the Subscription-Based Economy Index (SEI), we can clearly see that subscription sales grow on average five times faster in comparison to sales of the S&P 500 companies and US Retail.

Source

But can we quantify this growth?

The average growth rate for subscription businesses is 19%.

The top 5% companies have a growth rate of 152% y-o-y while the worst performers lower the average with a negative growth rate of -51%.

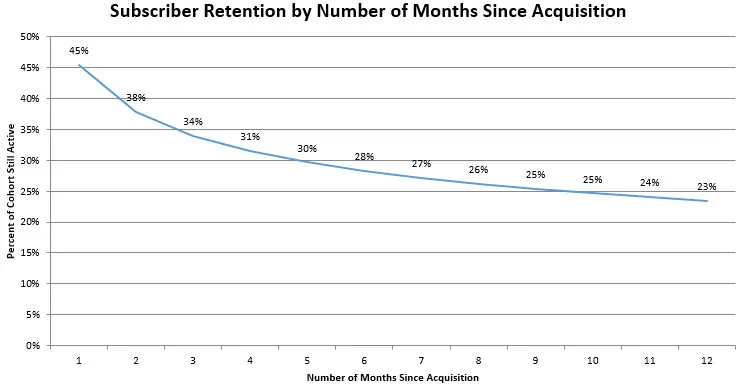

The average churn rate is 27%, with top performers at 4%, and the fifth percentile exhibiting an extremely worrisome 61%.

These numbers might seem alien to SaaS providers, but we have to take into account that this data encompasses all subscription businesses in B2C as well as B2B in different sectors.

A healthy growth rate in SaaS is usually much higher while an acceptable churn rate leads healthy companies to lose on average one out of 200 customers per month.

Additionally, churn rate varies a lot in accordance to billing models.

Companies that bill annually have a much lower average churn rate (24%) than companies that bill monthly (32%), and this also affects the ARR growth rate which loses 16 points from 28% (annual billing model) to 12% (monthly).

Growth Strategy in the Subscription Economy

For subscription companies, prioritizing an acquisition-based growth is a viable strategy for B2C business that show an 83% gross account growth and corporate service companies (consulting, IT services…) that, in fact, present a 0.8 correlation between new account growth and annual recurring revenue (ARR) growth.

In B2B, and specifically in SaaS, the correlation between ARPA growth and ARR growth is slightly over 0.5. Account retention becomes essential as growth through retention and expansion is the only way to scale fast.

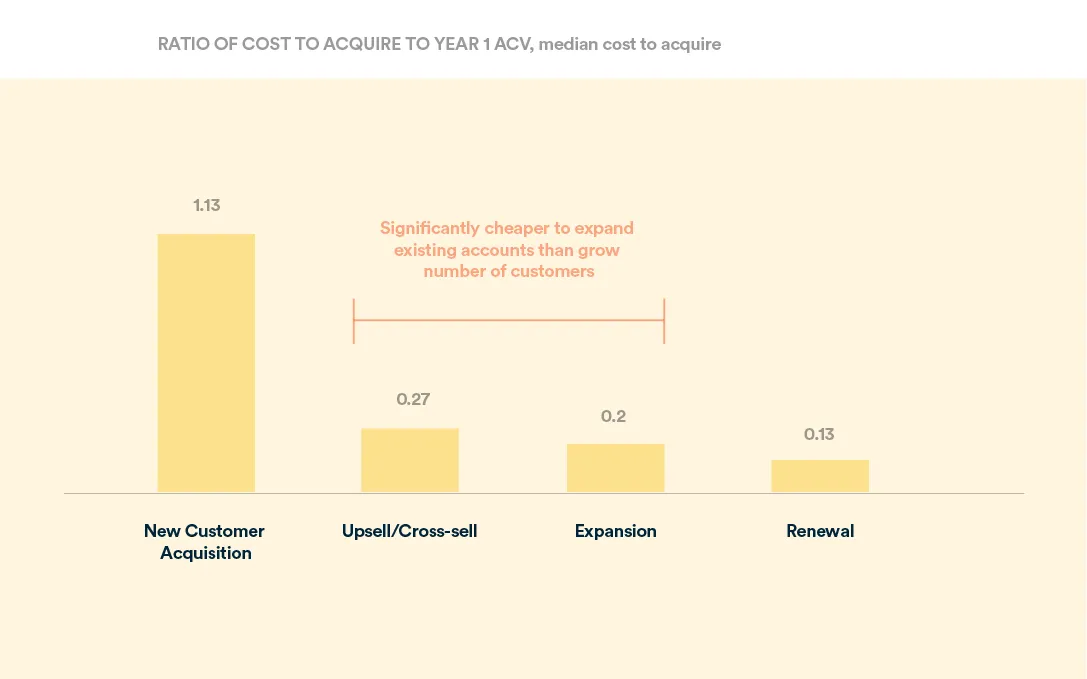

To understand the concept, let’s compare the median costs to generate the initial annual contract value (ACV).

New customer acquisition costs dramatically exceed renewal and expansion costs.

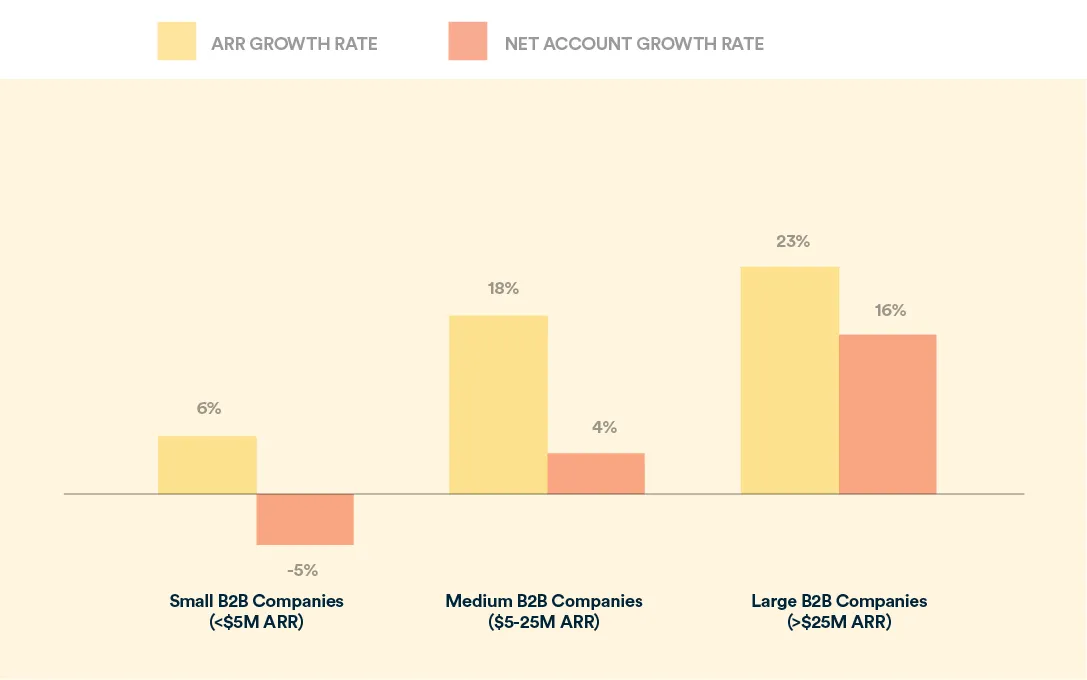

The relation between ARR growth rate and net account growth rate varies for B2B subscription-based businesses according to their size and maturity.

This shows that scale matters and it can fuel growth.

But acquisition and retention aren’t the only weapons of subscription businesses.

Focusing on increasing ARPA obviously plays an important role as well.

One way companies achieve this (especially in B2B) is by reviewing their pricing policy.

Companies like Netflix leveraged pricing as a mechanism to boost revenue growth after reaching a certain level of market saturation that heavily impacted subscriber growth rate.

But wait a minute. How can they keep charging more without losing customers?

The secret is starting at a very low price.

A very low entry price means quickly growing by acquiring lots of initial subscribers.

While growth rate through acquisition slows down due to market saturation, the company can improve their offerings, provide more services, and prove to be even more valuable to their existing customers.

This, combined with the fact that the initial price was so low, leads to an inelastic model that fuels a second wave of growth.

Is this model viable for B2B subscription-based businesses as well?

It really depends on the business model. SaaS companies, for example, tend to have very high acquisition costs at the beginning.

Oftentimes, less mature B2B companies also lack the automation necessary to reduce onboarding costs.

This translates into higher entry prices and for such businesses, pricing can’t be immediately used as an instrument to increase ARR.

For some other SaaS businesses, this strategy might be a viable solution as they can enter the market with a single simple product and increase prices over time while adding features, products, integrations, and services.

And speaking about that. Is offering more products with a multitude of pricing options a winning strategy?

The Paradox of Choice: Too Many Jams

Almost 20 years ago, psychologists Sheena Iyengar and Mark Lepper from Columbia and Stanford University published a study about choice overload.

The famous jam experiment proved that customers who are presented with too many choices are less likely to commit and buy.

Customers who could only pick from six different sorts of jam bought a lot more jam than customers who were presented with a huge display table with 24 different kinds of jam.

Choice overload leads to paralysis. Customers seem to be motivated to buy when they feel in charge of their own decision and clearly understand what they want without focusing on too many details.

If this applies to fruit preserves it must also apply to B2B services, right?

Well, the plain answer is yes.

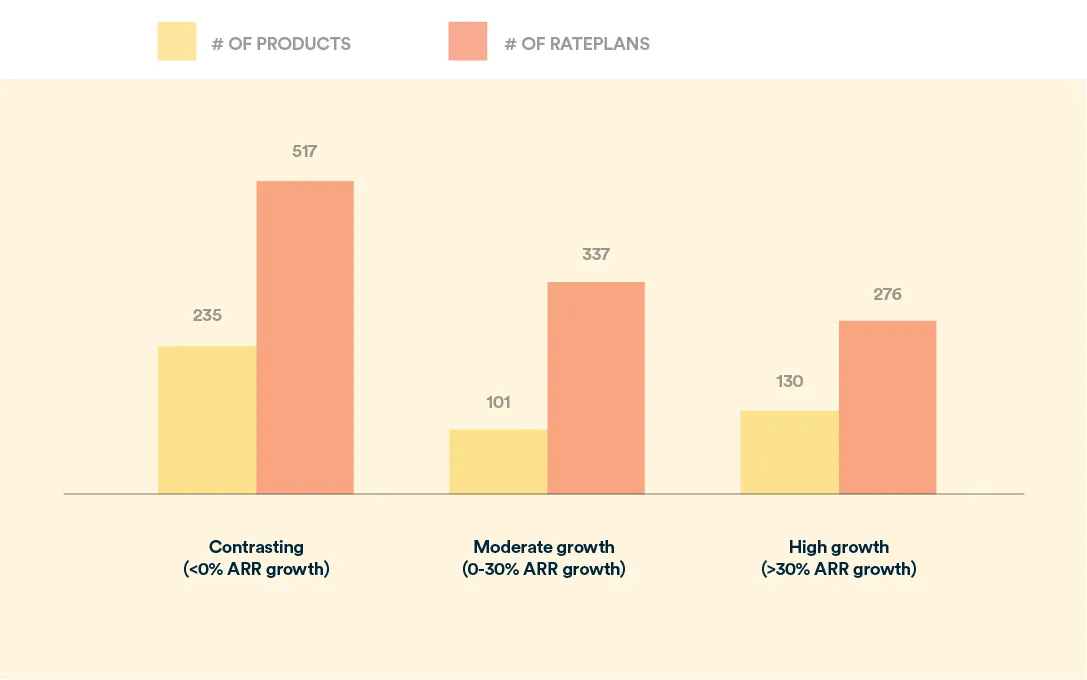

B2B companies that have the highest growth rate are also those companies that offer fewer products and pricing options.

Companies that exhibit a higher growth rate tend to offer fewer choices both in terms of products and pricing tiers.

Discounting and Pricing Strategy in Subscription-Based Businesses

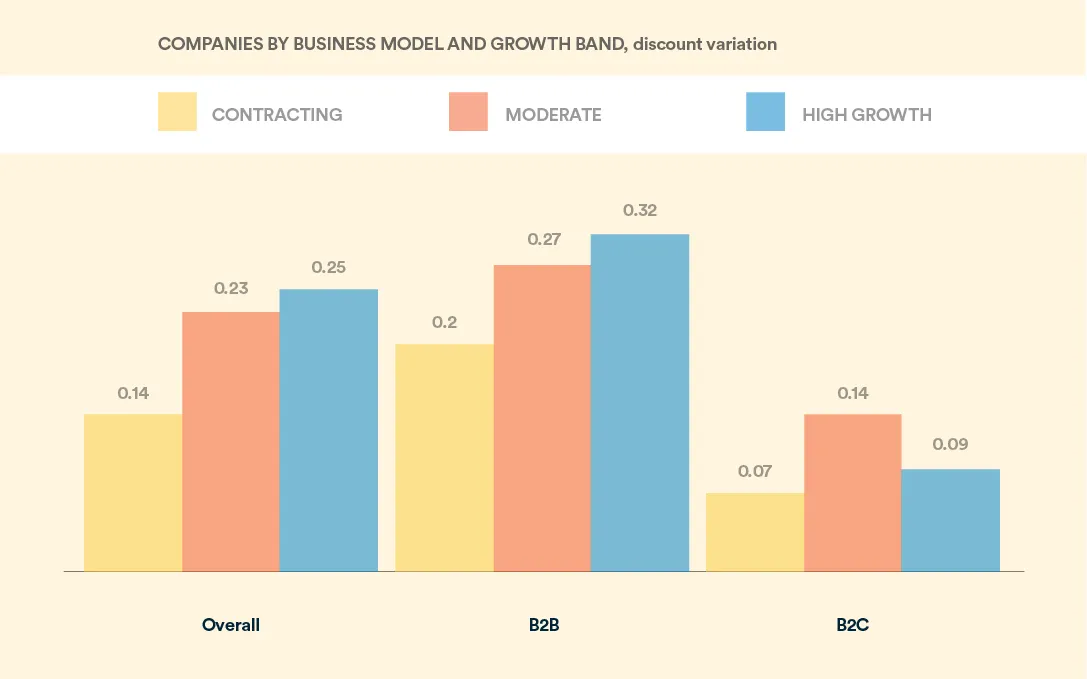

When it comes to discounting and flexible pricing, we encounter some more differences between B2B and B2C companies.

High-growth B2B subscription businesses strategically model flexible pricing and discounts to make sure to enhance customer value.

When it comes to pricing, there’s a plethora of options for subscription businesses.

The fastest growing companies appear to be those that implement a value-based model.

High-growth B2B companies abandoned an access-based flat fee model in favor of a “per-unit” kind of model.

This leads, on average, to a 30% ARR growth, whereas implementing too much flexibility without a dominant pricing model leads companies to average 133% less ARR growth.

The SaaS Rule of 40: Does It Still apply?

As far as growth and profitability are concerned, the key indicator in recent years has always been connected to the rule of 40.

If you are not familiar with the principle, the rule simply states that growth rate + profit should be greater or at least equal to 40%.

When it comes to growth, the parameter can be ARR, and profit can be expressed as EBITDA, Net Income, or operating margin. For larger (public) corporations the variables can be revenue growth rate and free cash flow margin.

Essentially, the rule states that if your growth rate is 60% you can lose 20% (-20% profit margin), but if your growth rate is 20% then your profit margin should also be at least 20%. A healthy SaaS business seems to be a business that complies with the rule of 40.

The biggest issue here is linked to the confusion about what variables you actually chose to populate the equations.

Then, you also have to take into account COGS (different infrastructure generates different cost structures) and sunk costs that might affect margins. And you also have to remove revenue generated through one-off services because these don’t actually impact MRR growth.

Plus, considering MRR growth rate versus ARR growth rate also makes a huge difference.

Therefore, this rule of thumb often generates blurry results that seldom prove to provide useful indicators.

The problem is that, in the past, we ended up with overly inflated evaluations since we only took into account revenue growth without considering margins.

That’s why the rule of 40 is still somehow relevant as it proves to be a more valid predictor.

Nonetheless, possibly also due to the limitations presented above, a large number of companies seem to deviate from the rule of 40 and the median value for public software enterprises is approximately 32%.

Source

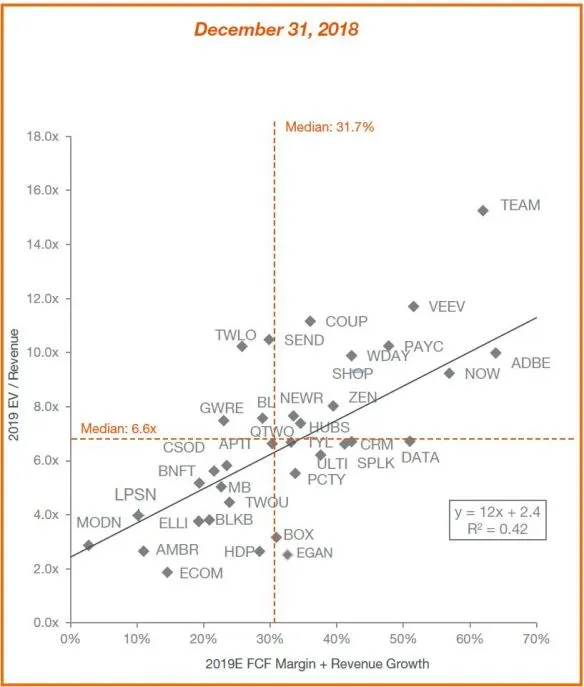

In this chart, we see the rule of 40 value on the X-axis and the enterprise value (EV) on the Y-axis.

The median value for R40 is 31.7% and less than half of the companies comply with the rule of 40. Variability in the chart can partially be linked to an R squared of 0.42 as shown in the legend.

If, on the one hand, it seems that the rule of 40 doesn’t actually provide immediately useful information, on the other hand, we can clearly see a correlation between R40 and revenue.

As shown in the charts, we can see that a 10% improvement in R40 leads the company’s revenue multiple to increase by 1.2x.

The results can also be partially skewed, though, as the chart only includes data of large public companies that proved to be successful (up to the point of being listed). Results would be a lot less dramatic if the chart also included private SaaS companies and startups.

Achieving and surpassing the 40% threshold seems to be a pretty clear predictor of success, but, it must be said, not complying with the rule of 40 is NOT a valid predictor of failure (as companies like Avalara, with an R40 of -2%, proved with their successful IPO).

However, no matter what different rules of thumb show, the point is that the subscription-based economy is growing rapidly as a whole and the sector is continuously being shaped by stellar IPOs and sensational M&A activities.

This proves that there are enough companies out there that show promising results in a thriving environment that seems to be destined to enduringly shape the global economy for the foreseeable future.

Churn Is Still The Biggest Obstacle to Growth

What kills subscription-based business faster, increasing CAC or churn?

I think we all know the answer. But it’s always interesting to see the power of retention in action.

During the session, we analyzed two case studies to evaluate the true impact of churn.

We compared Blue Apron versus Slack.

We started by looking at Daniel McCarthy’s analysis of Blue Apron’s unit economics.

Standard indicators looked spectacular for Blue Apron in the beginning. With a 53% market share and revenue growth of 100% y-o-y, the company seemed destined to become the decacorn in the meal kit industry.

Slack presented a lower growth rate with $400m ARR and $154m operating loss in FY2019 (-38% OM).

However, Blue Apron faced a 70% customer churn rate within a six-month period after acquisition with skyrocketing CAC. The huge spread between CLTV ($133) and CAC ($161) heavily impacted expectations in the market and the stock price plummeted to less than $7 per share from an IPO price of $120 (which was already 25% below target).

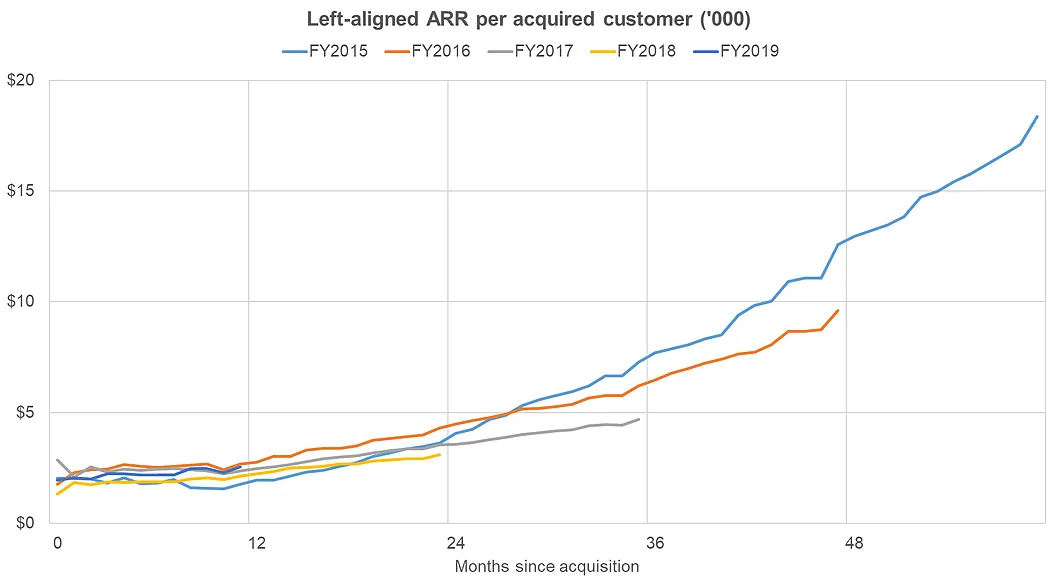

For Slack, the future seems a lot rosier, as the collaboration tool achieved negative churn with a mere 10% churn rate at Y1, an average retention period of 5 years (for over 80% of the customers), and increasing ARPA with a median increase from $3K to $15K in four years for all the cohorts since 2015.

Slack faces increasing CAC ($8K this year, up 40% from the previous year) but retention rate boosts CLTV to an estimated post-acquisition customer value of approximately $107K. That’s a 1,300% return on CAC spend.

Slack’s IPO is way too recent to draw any conclusions, but despite the lack of a proper track record, we can already see that their IPO exceeded expectations by almost 50% ($40 per share versus $26) and the price has been pretty much stable since then.

Wrapping up: The Golden Rules for Subscription-Based Businesses

All in all, I can’t say I was really surprised with any data presented during the session. If you’ve been working in the subscription-based sector for a while, you should also be familiar with most of the findings reported.

However, the event also involved interactive group activities that added pleasant elements to the mix and forced me to approach the basics of the subscription business model from different angles.

The golden rules are easy to sum up:

- EBITDA + CAGR >> 40% (with all the caveats I presented above)

- MRR from new customers + MRR from Expansion > MRR churn (negative churn)

- CAC << CLTV

These rules have always represented the basic elements of a healthy subscription-based business. Data can only confirm what we all know.

However, the most important takeaway for me is framing the subscription-based business model as a strategy that focuses on fostering a healthy relationship with your subscribers.

We often talk about retention, customer health, renewals, upsells. But the key element of the entire strategy is the human being at the center of our operations and the experience we create for them to nurture a long-lasting relationship based on trust and value.

This, for me, is my personal takeaway of the day, and I really look forward to attending the next Zuora event in November!